Like many of her neighbors in Kampong Cham, Seang Sinath borrowed tens of thousands of dollars to invest in a tycoon’s land scheme, falling into overindebtedness when the company stopped paying her back.

Sinath, who had been relying on monthly payouts from the investment to repay her $30,000 Sathapana Bank loan, asked her 16-year-old daughter to leave her grade 10 classes and travel to Phnom Penh to earn money as a food seller to help meet the $750 monthly interest payments.

“I regret this, I didn’t want my daughter to drop out of school,” Sinath said. “I sold everything I had, including my motorbike.”

Hundreds of people from across several provinces have reportedly lost tens of millions of dollars after investing in an alleged land fraud by the tycoon Hy Kimhong’s Piphup Deimeas Investment Co., Ltd. Many of the investors, from middle to low-income farming families, took out micro and bank loans to invest in the company and are now forced to take desperate measures to repay debt. The scheme mirrors other alleged frauds landing other tycoons like Chea Saran into prison earlier this year.

CamboJA spoke with 10 investors in the Piphup Deimeas company who say they are under intense pressure from credit officers — part of an industry already facing scrutiny for allegedly coercive and predatory practices — to repay debt, leading to migration, children dropping out of school, alleged suicides and the sale of their possessions and farmlands. In Kampot alone, there have been more than 1,100 complaints against the company and an estimated $21 million lost, police say.

The Cambodia Microfinance Association has expressed concern about the situation but claims authorities and the company must resolve the matter. Raymond Sia, Chairman of the Association of Banks in Cambodia, declined to comment, saying he has “not been informed” of the issue.

Meanwhile, after being arrested, charged with fraud and sent to pre-trial detention in early August, the tycoon Kimhong is reportedly seeking bail and his wife is urging the company’s victims to withdraw their legal complaints, promising he can repay them.

Seng Heang, deputy prosecutor of the Phnom Penh Municipal Court, said that Kimhong remained in pre-trial detention as of Friday afternoon.

One of the company’s investors, Ma Sarim, told CamboJA that he waited six months before investing in Piphup Deimeas after the company’s marketing representatives repeatedly visited his home in Kampot province’s Thnong commune to promote the investment opportunity and highlight the company’s rapid growth and profits.

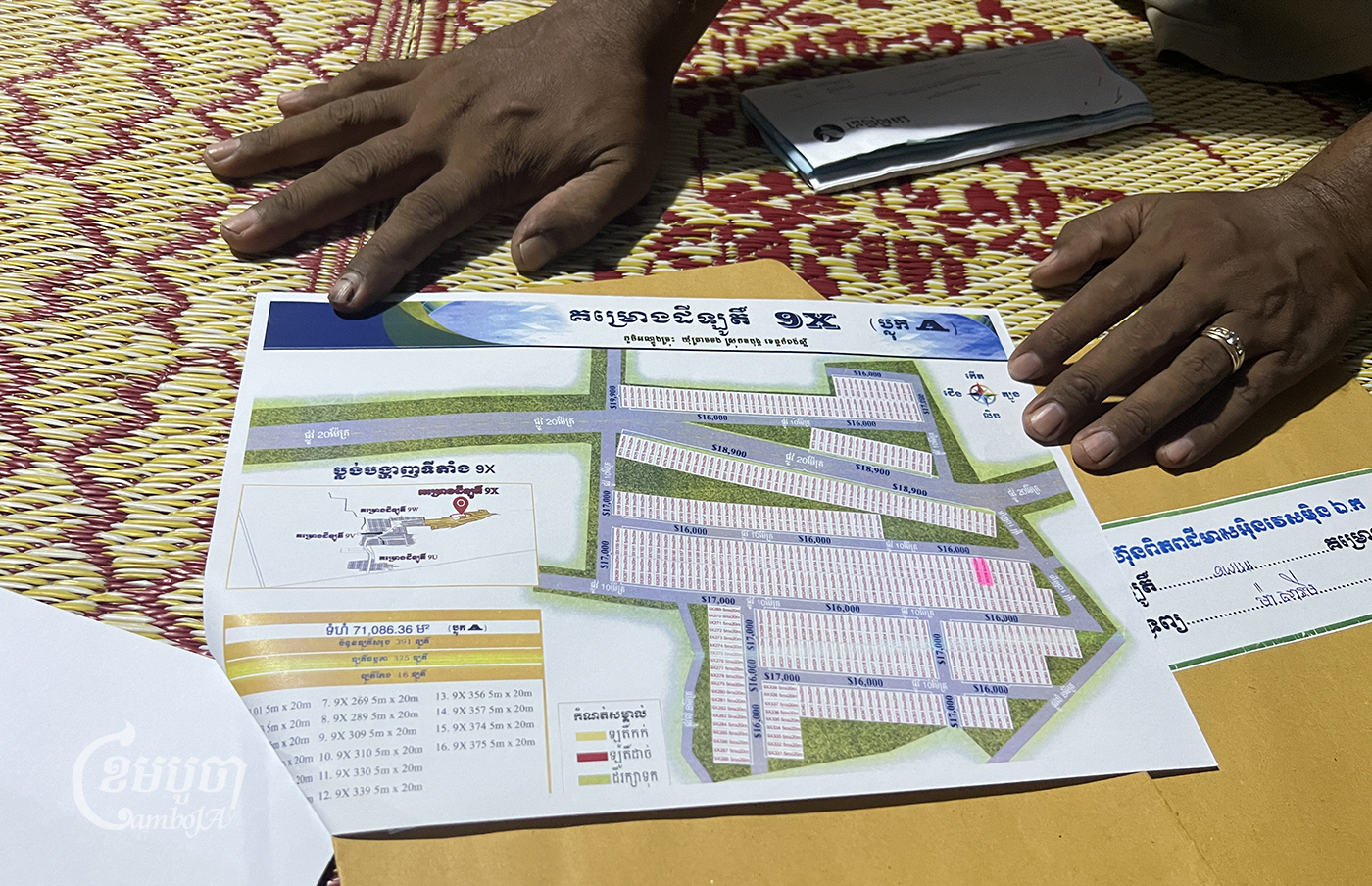

“The principle of the Piphup Deimeas company is that we take the money to buy the land, the company provides 3% interest every month and every 24 months the company buys the land back at the original price,” Sarim said. “The marketing staff told me…I do not need to do any business and I just get money every month. They claimed to be a legitimate company from the government and will be held accountable if anything happens.”

Sarim recalls thinking “he [Kimhong] is the tycoon and the tycoon does not hurt people” as he finally decided to borrow $45,000 from ACLEDA Bank, while his cousins and around 50 other families in his village of Prey Thnorng borrowed large sums to invest as well.

“The investment with Piphup Deimeas, I can say 90% of [investors] borrowed from microfinance and bank. No one has their own money and that is a problem that harms our lives because we have no money to pay for monthly interest,” he said.

But Sarim admitted that he had lied to ACLEDA about the purpose of his loan, claiming it was intended to start a business, and he acknowledged that many of his neighbors had also likely misled credit officers about their intentions for the money.

Sarim anticipated the investment would lead to a stable income and a higher quality of life, and for the first eight months after his investment he earned around $1,380 each month from Piphup Deimeas. But then the payments stopped in April and his income plummeted.

Sarim says he and four relatives lost over $200,000 in investment and his family is now selling two of his 2.5 hectares of farmland for $20,000 and earning another $23,000 from the sale of the family’s car and two trucks he used for his agriculture business — just to cover the monthly interest payments.

“Since April, I have not made any profit. The company kept promising until we came together to file a lawsuit,” Sarim said. “What we are all concerned about the most is paying the bank interest because when the deadline comes, we all need to pay for the interest, and that is beyond my ability.”

Sarim claimed at least one person committed suicide due to the debt, but Prey Thnorng village chief Kong San denied there had been any deaths or debt-driven migration.

He says that many people in his village have migrated to Thailand due to the pressures of repaying their debt or in the process of preparing documents to travel there, and he himself is planning to seek work there.

“The money I owe to the bank in this life, I don’t know whether in the next life I can repay the bank or not,” Sarim said.

Microlending Industry Deflects Blame for Debtors’ Problems

The resulting overindebtedness is affecting investors across other provinces as well. Kampong Speu resident Im Chan, 40, invested $15,000 in Piphup Deimeas.

“I asked my son to drop the school and help me pay the debt, but he said he wants to study, but now I need to pay $500 per month with Amret [Microfinance Institution] and it is over my ability to pay this amount,” said Chan, who is pushing her son to seek work at a garment factory.

Amret and Sathapana did not respond to requests for comment about borrowers pulling their children from school to repay debt, echoing a phenomenon documented in a quantitative study on microloans commissioned by two human rights NGOs and published in August. Both these institutions, as well as ACLEDA and three of the other biggest microlenders in Cambodia, are under investigation by the World Bank’s International Finance Corporation for allegedly predatory lending practices and debt collection tactics.

Human rights NGO Licadho’s Operations Director Am Sam Ath said when credit officers pressure and coerce borrowers to sell their farmland, house or property for debt repayment it will harm their living and undermine their ability to earn future income. He added that lenders should work to resolve the issue with borrowers proactively.

“People depend on their land to live and if there is a case where [credit officers] force people to sell their land it will seriously affect their right, the bank should give them time to pay the debt and not just force them to sell their land, this is not right,” Sam Ath said.

Cambodia Microfinance Association (CMA) spokesperson Kaing Tongngy said that he regretted the circumstances of Piphup Deimeas victims and said the microfinance sector did not intentionally provide loans to people investing in fraudulent companies. But he said the responsibility to deal with the problem rested on authorities and that debtors remained obliged to their creditors.

“We should deal with companies that cheat in accordance with the law, and what people should do is take the issues to discuss with the bank and see what can be done according to their actual ability,” said Tongngy. “Only when the customer is honest can a solution be found and avoid the online or privately loan during this time.”

“In case of credit officers’ coercion, please complain to the local authority or microfinance institution to report the inactivity of some officials,” Tongngy added.

In Channy, president of ACLEDA Bank, which also holds a large portfolio of microloans, did not address CamboJA’s questions about whether the bank would provide any debt relief or solutions for borrowers’ who had lost money and income from the collapse of Piphup Deimeas. Instead, he claimed that ACLEDA never allowed customers to borrow money for land speculation, despite testimony of borrowers like Sarim.

“Banks never give money to customers to buy the land or to invest on land like that never ever happens, go and ask them, we don’t have that policy,” Channy said.

Tongngy blamed local authorities for not taking timely action until thousands of people became victims with significant debt, and said the CMA was seeking to convene “stakeholders” for a meeting to address the crisis of the company’s investors, which has already been unfolding for months.

“There have been discussions with the National Bank of Cambodia and other stakeholders to alleviate the problem. But this stage has not yet come to fruition because involved parties have not worked and understand each other yet,” Tongngy said.

Kampot’s police chief Chanmathurith said he “can’t be involved in this case because it is out of my hand now, so they should wait for the solution from the court or to negotiate with the bank.”

Tycoon’s Wife Tries to Silence Complainants

Hy Kimhong’s wife, San Sotheavin and a phone number for the tycoon’s assistant could not be reached for comment. CamboJA tried to contact Piphup Deimeas company via the contact on Facebook page and website but received no response.

While acknowledging in August that it could not pay back its investors, the company has insisted in public statements that it is a legitimate business and will meet obligations of customers.

Sarim, who is a representative of Kandal province victims of the alleged fraud, said that Sotheavin has been lobbying representatives to withdraw complaints against her husband and that many victims believe they are more likely to get repaid if he is out of prison.

“I can say we are volunteering to be silent after he [tycoon] is released on bail because we want the solution more or less is better than nothing, if he is released on bail and still doesn’t take responsibility this is our karma,” Sarim said.

Another Kandal resident, Thol Sokhorn, 42, also said she hopes the company will take responsibility for her $20,000 Amret loan and echoed Sarim’s claim that Sotheavin was trying to convince complainants to be quiet.

“More or less I still hope [he will do this] after he is released on bail,” Sokhorn said. “Hy Kimhong’s wife asked those who haven’t fill the complaint not to fill the complaint and asked those who already did to withdraw the complaint.”

Ear Ly, another Kampot resident who filed a complaint against Kimhong, said he was doubtful that Piphup Deimeas would truly solve the problem because there appear to be thousands of victims and millions of dollars to pay back.

Ly, who in order to invest in the company took out a $20,000 ACLEDA loan with monthly interest of around $400, said he didn’t expect full justice would be delivered and expected Kimhong to leave pre-trial detention on bail soon.

“I believe in the judicial system 50% and another [outcome] 50%. I still wait for the authorities to take action toward this issue,” Ly said. “Most of the victims want to give him another chance if he truly wants to solve the problem, if he doesn’t intend to do so, we will sue him again.”